As more financial services and transactions are provided online, new cyber risks continue to arise in the financial industry. In the age of digital transformation, cyber criminals are taking advantage of new innovations, leading to an increasing risk that businesses must face. The financial industry remains one of the most attractive targets for a cyberattack due to the possibility of a high reward in the case of a successful attack.

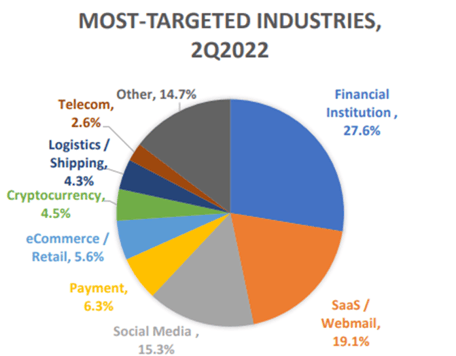

The financial industry holds sensitive documentation that is being digitally transferred and shared with customers and financial partners, leaving email as a key target for threat actors. According to the Anti-Phishing Working Group’s (APWG) Phishing Activity Trends Report, the financial industry has remained the highest target for phishing attacks from Q4 of 2021 all the way through the first half of 2022. In the second quarter of 2022, 27.6% of all phishing attacks were targeted directly at the financial sector.

(APWG Phishing Activity Trends Report, Q2 2022)

(APWG Phishing Activity Trends Report, Q2 2022)

The Most Common Types of Cyberattacks Targeting the Financial Industry:

- Phishing – An unsuspecting recipient receives an email that appears to come from a trustworthy source. The goal of the threat actor is to lure the user into revealing sensitive information or clicking on a malicious link or attachment that will install malware in the system.

- Whaling – A cyber criminal targets their phishing methods at high-level executives at a company to trick the victim into carrying out a specific action, such as revealing data or transferring money.

- Ransomware – Hackers will hold a system hostage until the victim pays a ransom. The financial services industry is a prime target for these attacks because of the highly valuable, sensitive data they hold.

- Distributed Denial-of-Service (DDoS) – Cybercriminals overwhelm a victim’s system and force it offline, either to launch another attack while security teams are distracted or to demand a ransom.

Cybersecurity Best Practices for Financial Firms

Establish a Cybersecurity Framework

It's essential to have a formal framework that your organization follows. First, identify your assets and resources that support your critical functions, as well as the risks your business is currently facing. You must have appropriate security measures in place to protect your organization and limit the impact of a cyberattack. If an attack occurs, it's necessary to detect and respond quickly to reduce downtime. After an incident, your organization should have a business continuity plan in place for resilience.

Continuously Monitor Your Network

An endpoint detection & response (EDR) solution will track and uncover cyber threats lurking in your environment, allowing your organization to take action quickly when an incident occurs. Continuous vulnerability scanning will provide clear visibility into your risk posture and allow you to fully comprehend the risks your organization faces.

Multi-Factor Authentication (MFA)

MFA creates another layer of security by requiring a user to provide more than one credential when logging in to verify their identity. When an account is targeted and one credential is compromised, the account is still protected by another required authentication method.

Have an Incident Response Plan

An incident response plan will allow your organization to respond quickly in the case of an attack. Your incident response plan could stop a cyberattack in its tracks and limit the repercussions. You should practice your incident response plan beforehand to ensure a smooth and fast response in the case of an actual threat.

Cybersecurity Awareness

Your employees are your first line of defense and should be aware of cybersecurity best practices, as well as the risks they face. Phishing training and exercises are essential to ensure employees are able to recognize fraudulent emails.

Your clients should be awareness of the risks they face as well. Clear communication is essential to ensure clients are educated on best practices that will lower their risk.

Contact us for more information on how you can enforce a solid IT strategy that will defend against cyber threats and give you the confidence that comes from knowing your business is always secure!

Read Next: Cyber Resilience: Is Your Business Really Secure?